My Advice+

Company— Scotiabank

Project role— Lead Designer

Responsibilities— User research, problem definition, design, testing

Overview

This project commenced at the onset of the COVID-19 pandemic, a time when financial uncertainty was heightened. While the project had been under discussion previously, the urgency became even more evident. There was a clear need to empower users to understand, manage, maintain, and build their financial health with confidence during this challenging period.

Process overview

Since this project would integrate into a new branch of the Scotiabank app's Information Architecture (IA), the team dedicated 2 weeks to discovery. This involved conducting team-wide workshops, literature reviews, analyzing surveys and reports by the Canadian government, analyzing existing research, and reviewing Net Promoter Score (NPS) surveys. Following the discovery phase, we facilitated workshops to brainstorm ideas and features that could address the identified challenges. This process led to the development of complex products that necessitated external partnerships.

Key challenges

①

Finances remain the foremost stressor for Canadians, highlighting a knowing-doing gap where planning often diverges from execution.

②

Money is laden with emotions such as shame, stress, ego, and power, contributing to its complexity.

③

Financial discussions are often closed off, lacking an open dialogue.

④

Diverse mental models, lifestyles, cultures, and racial backgrounds all influence financial behaviors, highlighting the need for diverse and inclusive approaches in financial services and education.

⑤

Accessible and contextual financial advice is scarce, hindering informed decision-making.

⑥

The overall financial experience is fragmented, further complicating matters for individuals.

Key insights

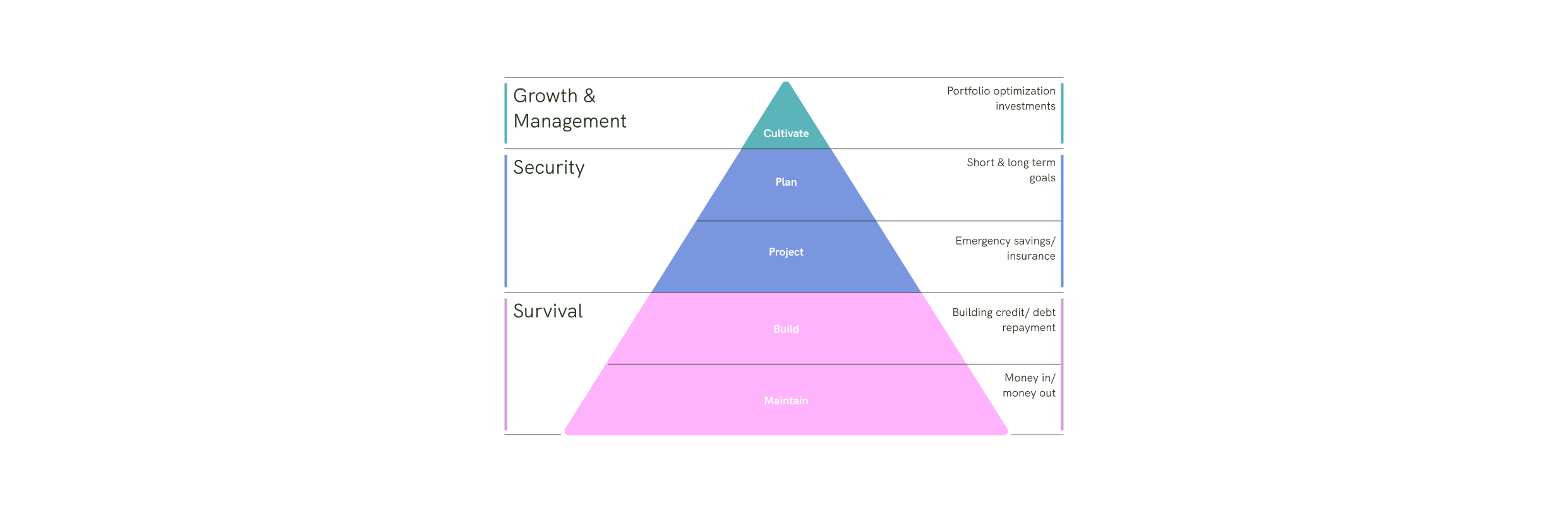

To empower everyone to manage their finances effectively, we must meet users where they are by tailoring solutions to their unique needs and circumstances. Personalization and contextualization are key, ensuring that financial experiences resonate with individual users and guide them towards informed decision-making. Acknowledging predictable irrationality, maintaining appropriate transparency, and allowing for meaningful customization further enhance user engagement and trust. Aligning financial solutions with Maslow's Hierarchy of Needs ensures that users' fundamental requirements are met while facilitating their pursuit of higher-level aspirations.

Money management styles can vary widely among individuals, with some preferring a "hands-on" approach, involving active monitoring and control of their finances. Others may adopt a "hands-off" style, delegating financial responsibilities or relying on automated systems. Additionally, there are those who might employ a "hands-on-the-hip" approach, combining elements of both active involvement and oversight. Each style reflects differing levels of engagement and control over one's financial affairs.

Customer demographics may not always be reliable indicators for targeting customers. However, by leveraging principles from behavioural economics, we designed for behaviour profiles instead:

- Structured saver

- Stockpiler

- Keen consumer

- Optimistic avoider

Mapping features on Maslow's Hierarchy of Needs provided a valuable model for understanding product feature goals, alignment, and priority. Existing products predominantly cater to the planning tier, with a limited focus on maintaining or building wealth.

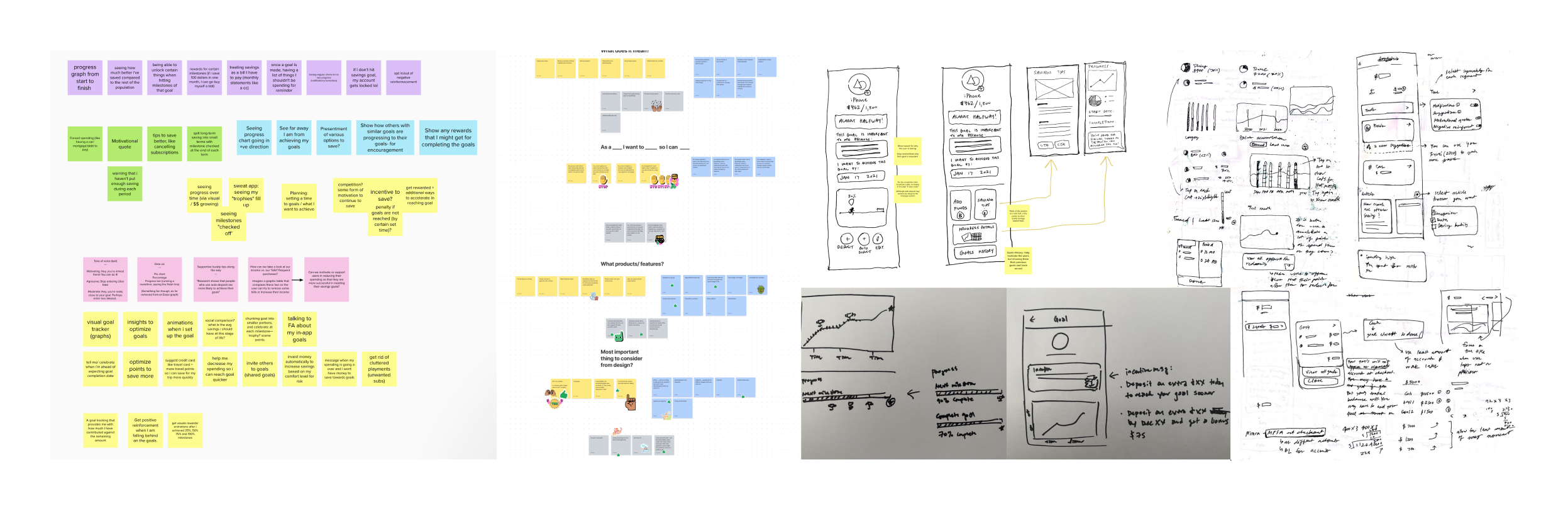

Ideation workshops

In the ideation and sense-making stage of this project, another designer and I co-facilitated workshops to establish the vision, define customer journeys, develop wireframes, and draft the app architecture.

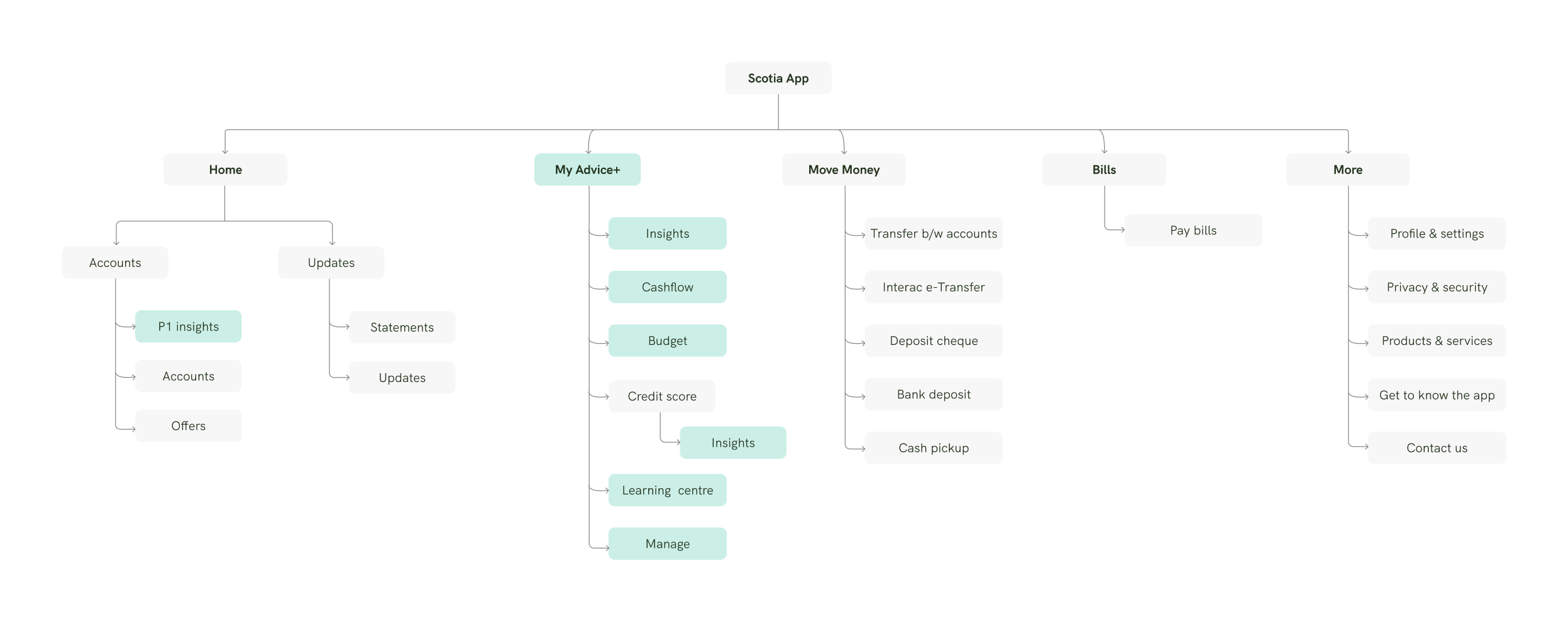

App IA

This new branch in the app prompts a reevaluation of its impact on other parts of the app and how it can be leveraged to tell a succinct story. The green pills in the diagram below represent new features associated with this product.

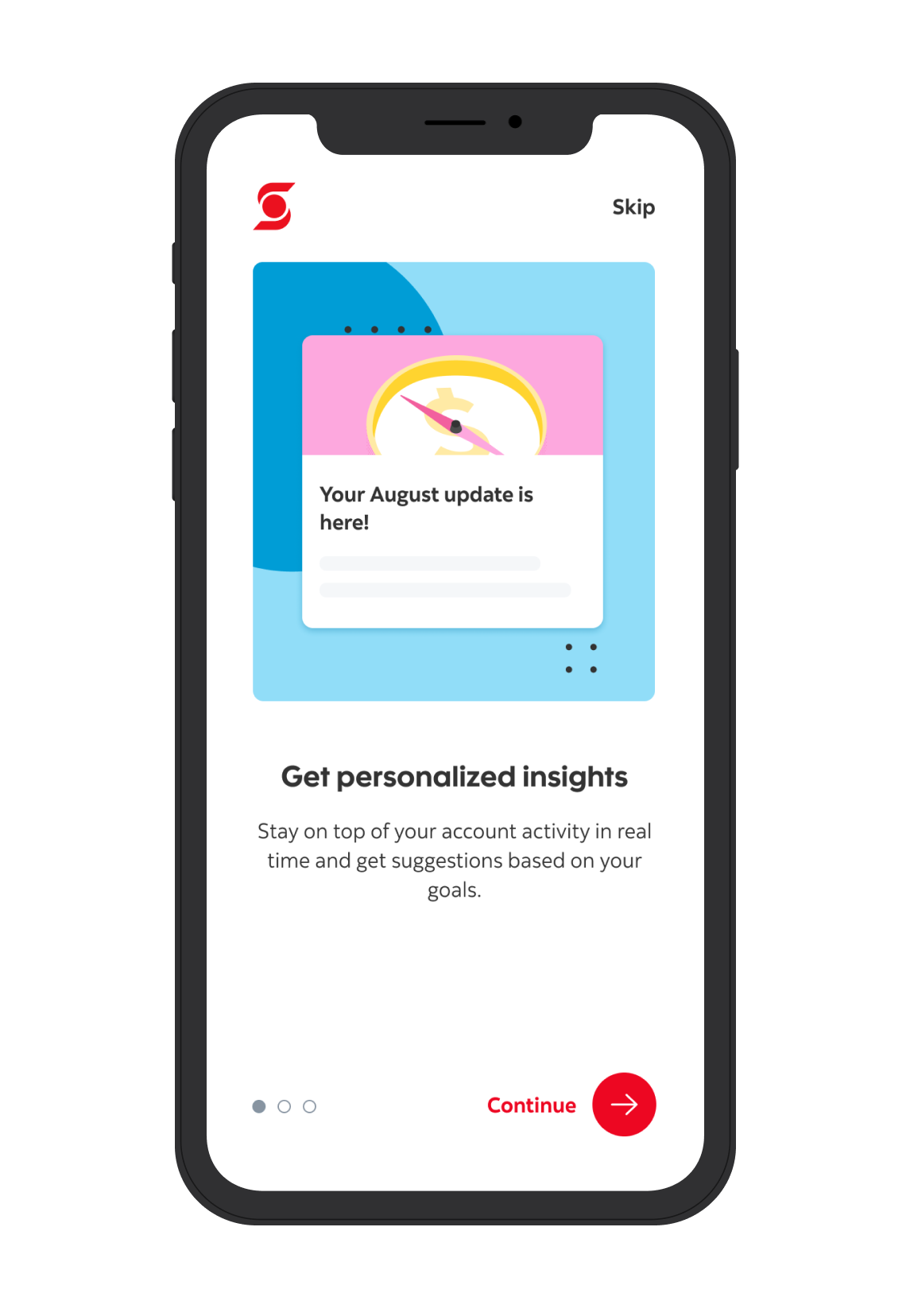

Onboarding

Enable customers to opt-in by first ensuring they understand the terms and how their existing data and records will be utilized to provide personalized insights and advice. Opting-in to personalized advice and insights has been shown to enhance customer trust in the feature, perceived usefulness of the feature, perceived competence of the bank, and reduce feelings of creepiness.

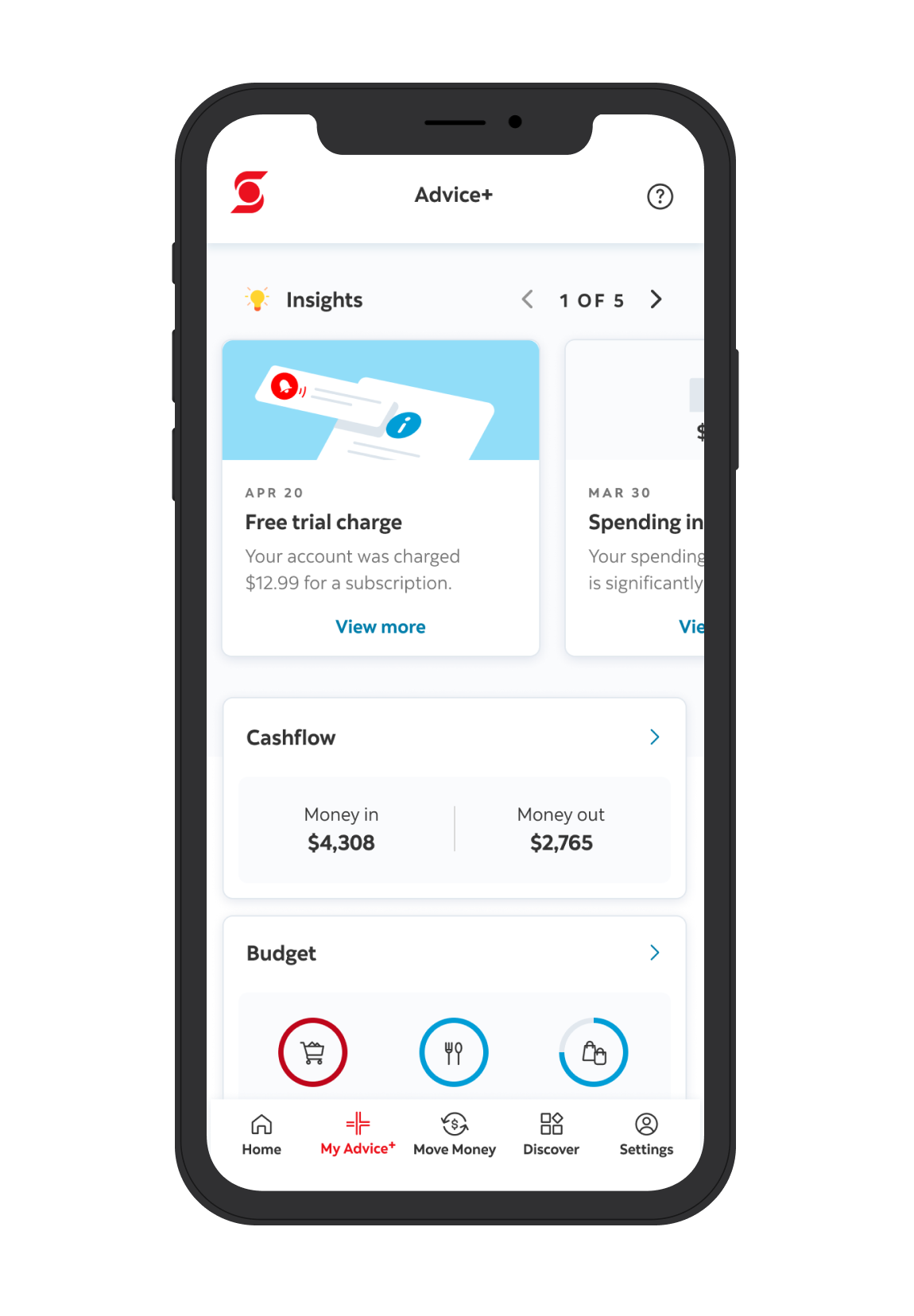

Advice+ hub

The hub acts as overview of financial health, and also serves as the entry point to all Advice+ features, including insights, cashflow, budgeting, and manage Advice+. The contextual insight framework not only informs users but also provides convenient options to take action when needed.

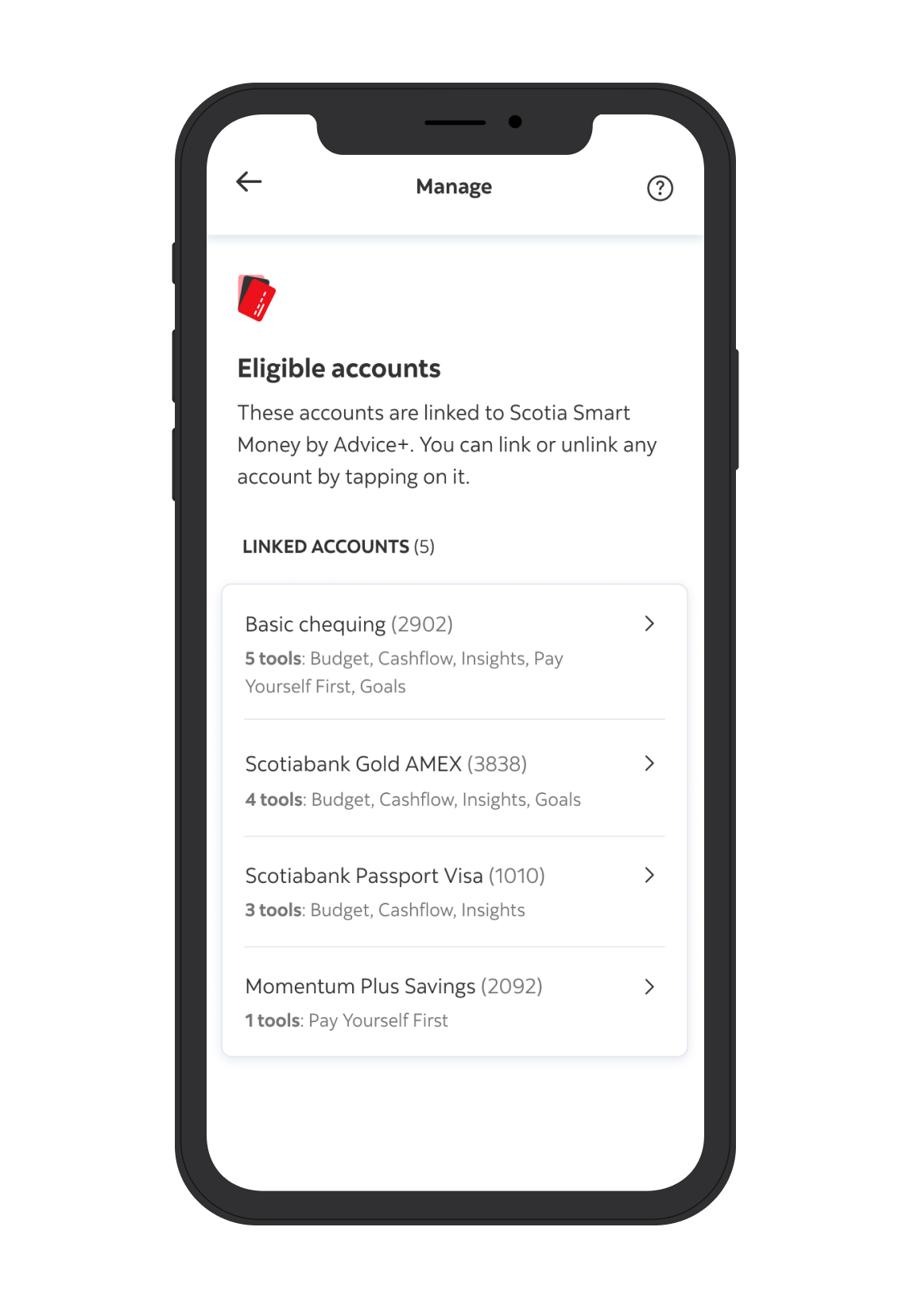

Manage

By offering personalized management of the feature, users gain more control over the advice they receive. They can easily link or unlink any account and see how each account is connected to various features.

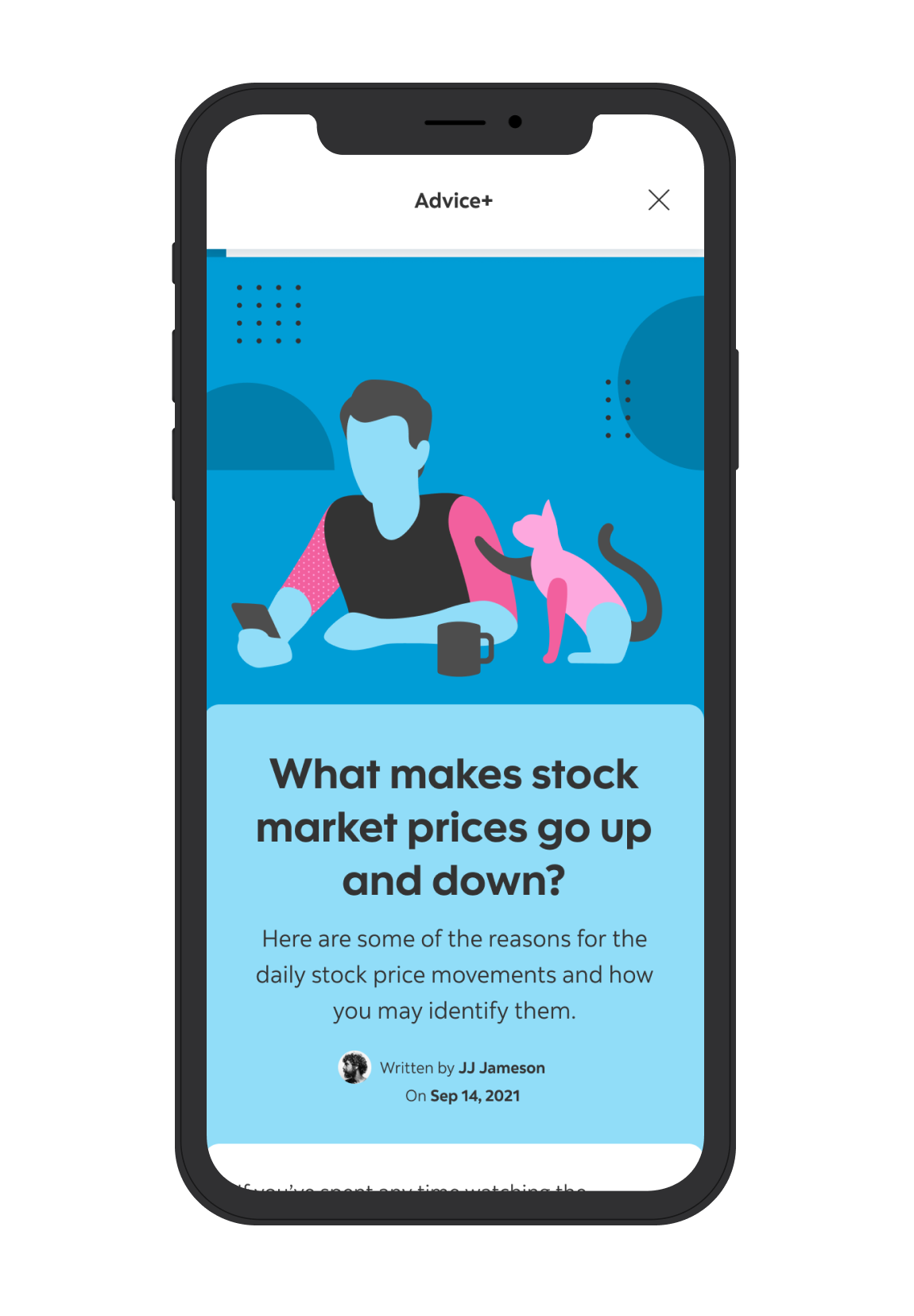

Learning center

According to a survey by the Financial Consumer Agency of Canada (FCAC), around 42% of Canadians show low financial literacy. This highlights the need for accessible and comprehensive information to empower individuals to make informed financial decisions. Articles are tailored to users based on their financial health or product preferences, aiming to address their specific needs and improve financial literacy.

:)

:)

Social media

©2021