Scotia SelectPay

Company— Scotiabank

Project role— Lead Designer

Responsibilities— User research, problem definition, design, testing

Overview

Installment plans offer a flexible way to manage unexpected expenses or indulge in luxuries, catering to a wide range of needs and desires. Studies examining the impact of these installment loan providers have shown a concerning trend: many consumers find themselves accumulating more debt after embracing these services, which are conveniently accessible at online checkouts. This project required a thorough examination of installment lending, delving into its benefits as well as its pitfalls. The goal was to empower consumers to make informed decisions, emphasizing responsible financial management rather than simply encouraging increased spending.

Challenges

①

Identify the ideal persona that aligns with both product advantages and business objectives

②

Easy to understand, enroll, track and cancel plans

③

Help users make informed decisions

④

Enhance transparency regarding fees, interest rates, and tracking

Process overview

In the initial discovery phase, we employed various frameworks to gain a comprehensive understanding of the problem from multiple angles. This included conducting user journey analyses, testing existing products in the market, performing competitor analyses, and conducting literature reviews. Subsequently, we validated the concepts through testing with identified personas.

Key insights

We delineated three distinct personas: transactors, revolvers, and transactors with revolver tendencies, the latter being the ideal persona. This persona embodies individuals who demonstrate good financial responsibility and health, occasionally carrying a balance for the sake of convenience or luxury.

I identified various methods of offering plans that extend outside the app including POS machines, post-purchase invoicing, and banking app integration. Initially, installment lending options in Canada were limited, but with the project's launch, numerous US startups entered the market.

The experience revolves around point key phases in the journey:

①

Discovery: Users become aware of the product and eligible purchases.

②

Enrolling in a plan: Seamless transition from making a purchase to enrolling in a plan.

③

Manage: Effortlessly track their plans and payments.

④

Post-loan experience: Provide additional information to maintain users' trust in the service.

Exploration

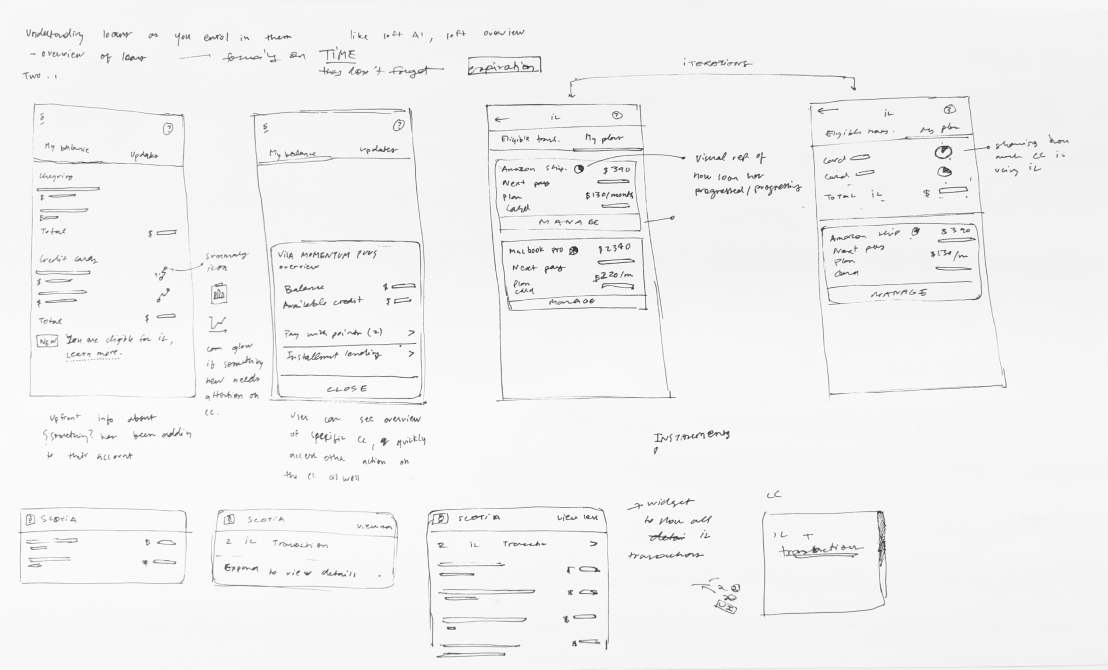

I explored various approaches to envision the installment lending process within the app, as well as alternative versions such as a Chrome extension and QR code integration at checkout. I then leveraged our design team and engineering forums to gather extensive feedback on UX, UI, and feasibility.

Validation

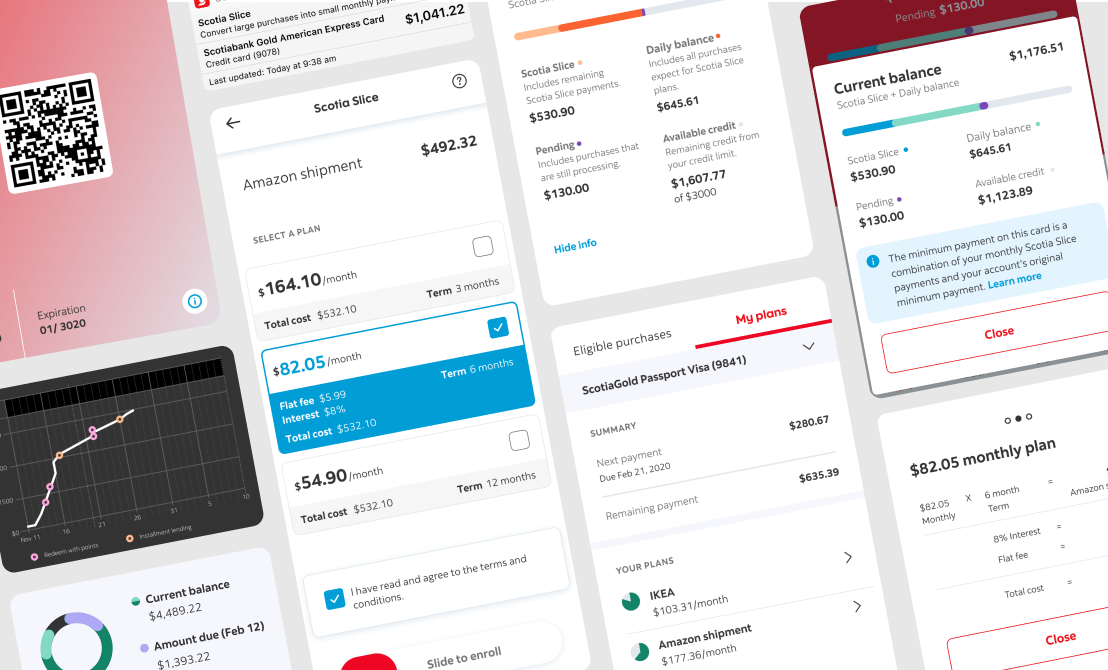

I developed a prototype focusing on core interactions and tested the app's usability internally before involving 5 research-recruited participants. Feedback from these tests was instrumental in refining the product, particularly in determining the timing and extent of information disclosure at each phase of the user journey, as well as refining the copywriting.

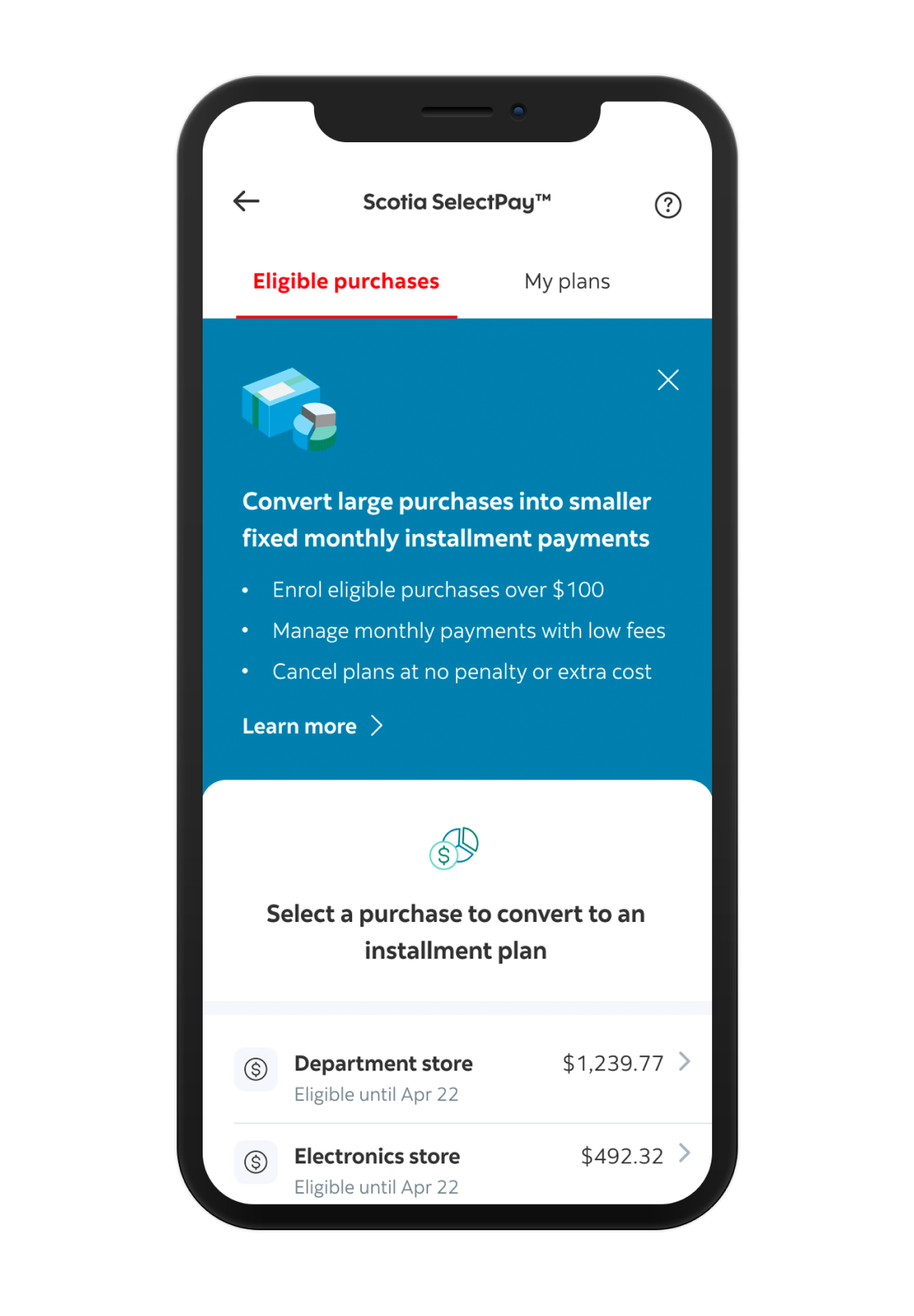

Onboarding

To enhance user understanding and generate interest, essential information is prominently displayed upfront about the service. Users can easily scroll through eligible purchases and tap to view three installment plans available for each item.

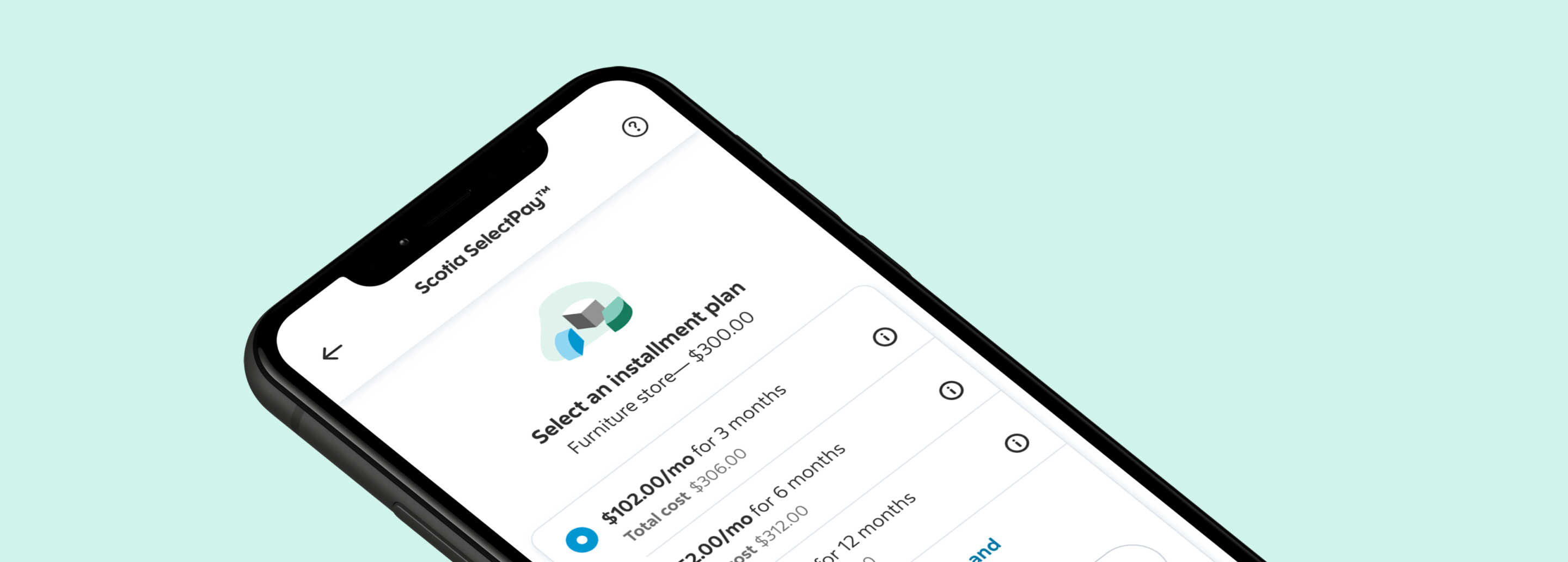

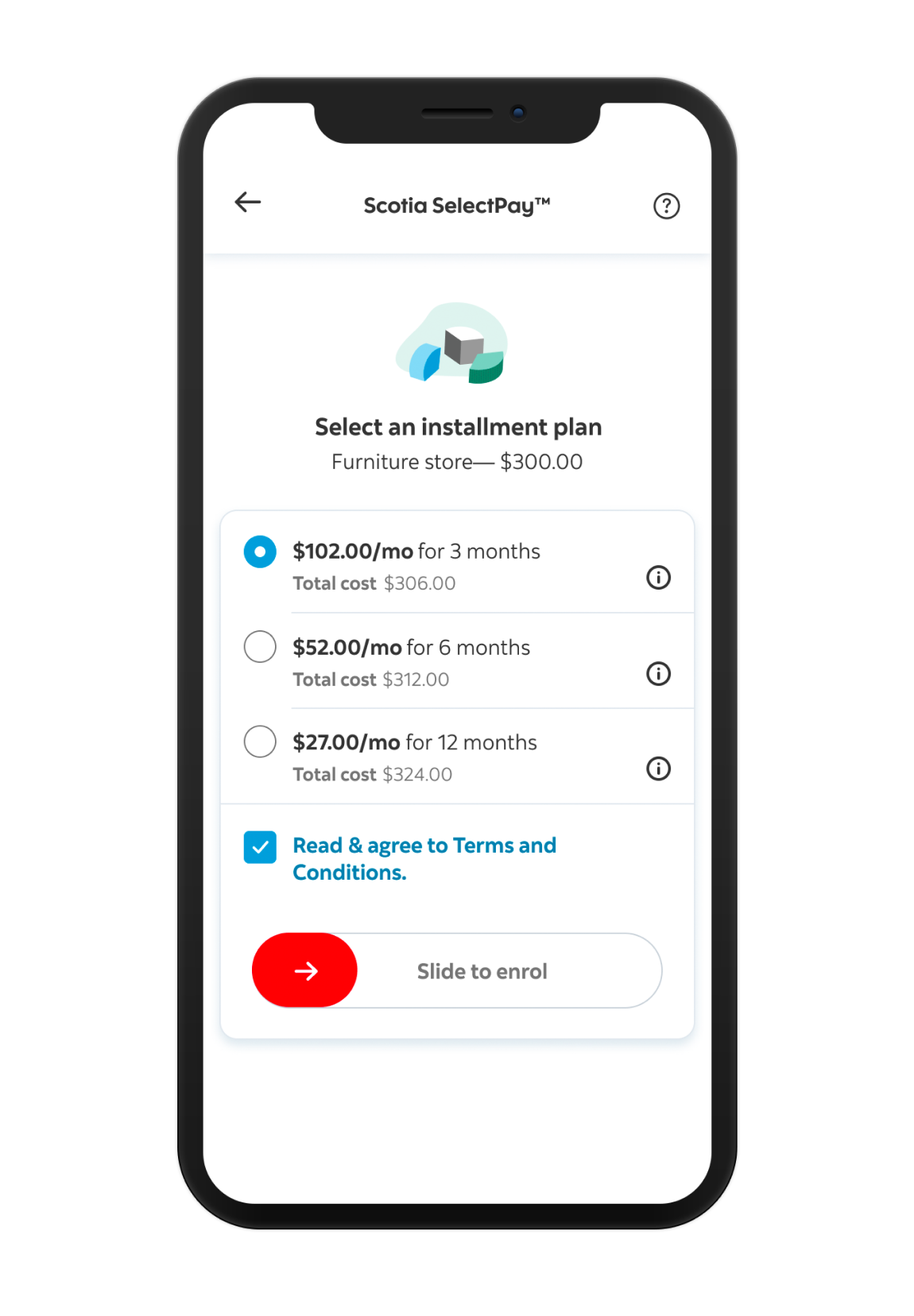

Pick a plan

Users can conveniently view all available plans above the fold, facilitating easier comparison. If users wish to delve deeper into understanding the breakdown of the total cost, they can access this information by tapping on the info tip.

(*Note: Numbers provided are for illustrative purposes and may not accurately reflect Scotia SelectPay's business model.)

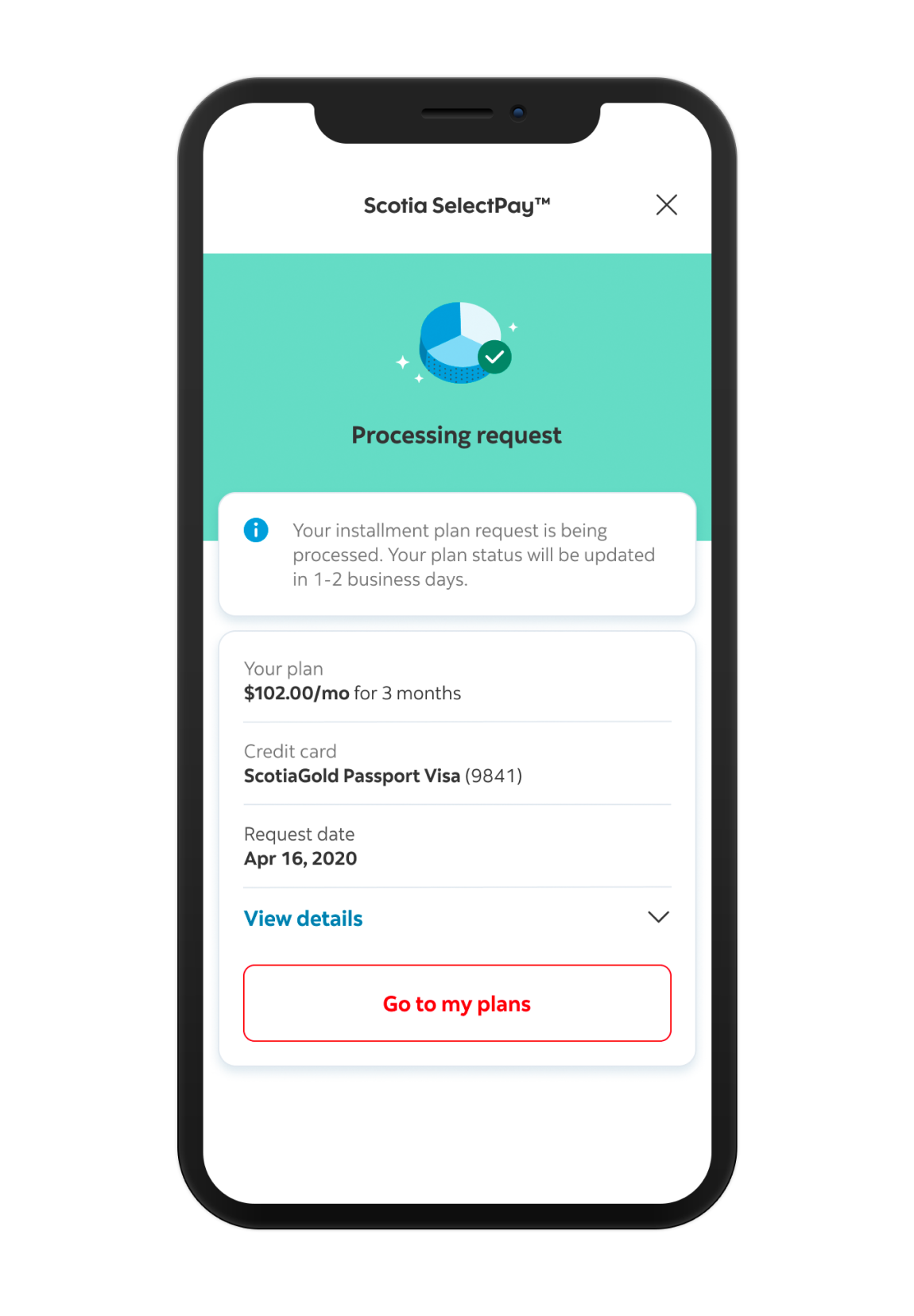

Post enrollment

Informing users about what to expect after submitting their request helps establish clear expectations and minimize discrepancies in their experience.

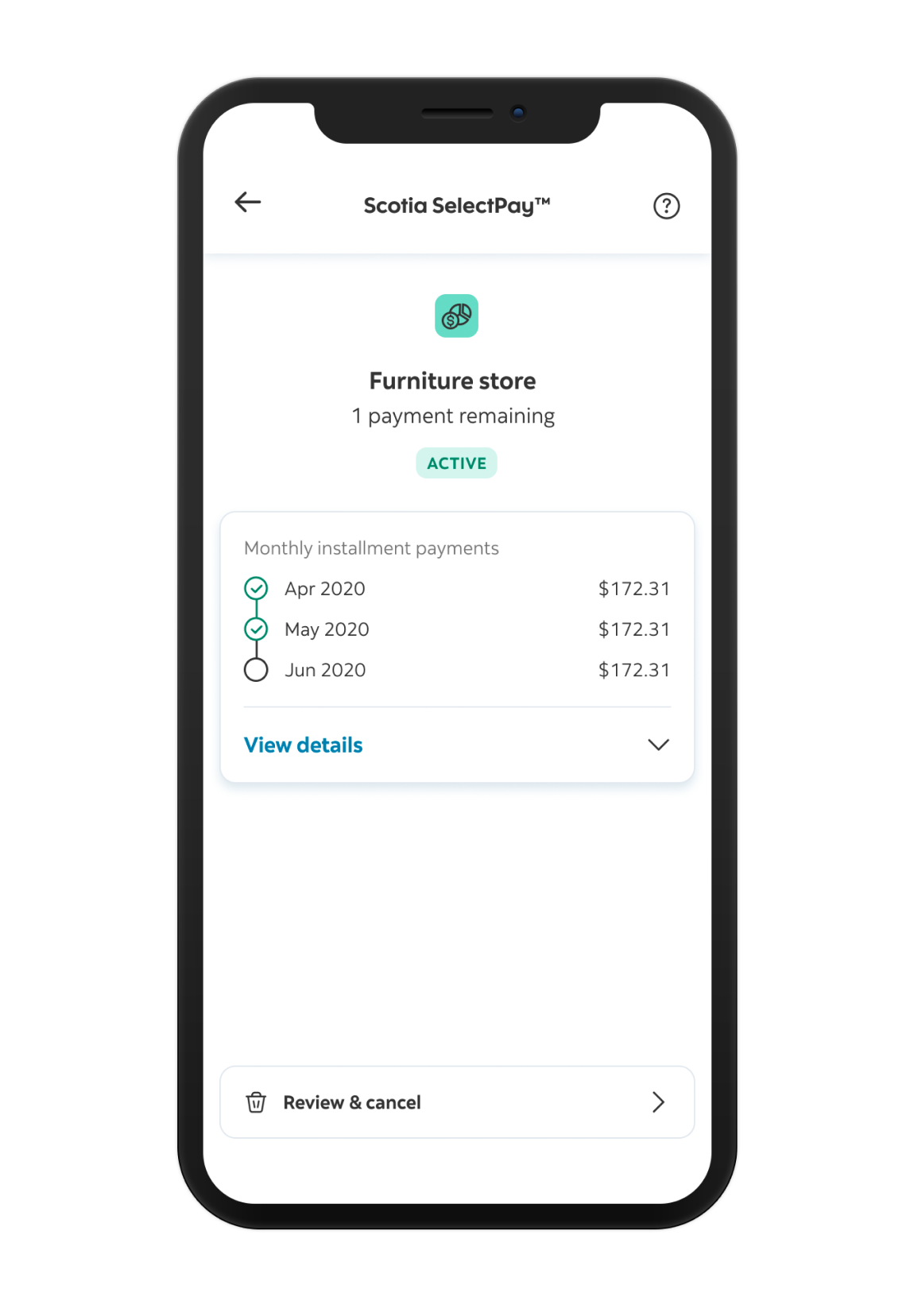

Track plan

Users have access to all information about existing plans under "My Plans." Additionally, they can easily view plan details and cancel plans as needed.

:)

:)

Social media

©2021