Credit Score

Company— Scotiabank

Project role— Lead Designer

Responsibilities— User research, problem definition, design, testing

Overview

Credit scores play a pivotal role in financial stability, affecting access to credit, interest rates, insurance premiums, and loan terms. Responsible credit management—such as timely bill payments, maintaining low credit card balances, and managing debt is essential for maintaining a good credit score. Despite its significance, there remain gaps in how the Scotiabank app communicates and presents credit scores.

Product gaps

Lack of guidance provided to understand current credit score

Lack of presenting tips and actionable steps to improve one's credit score

Lack of credit score literacy

Process overview

During the discovery phase, we employed various frameworks to gain a comprehensive understanding of the problem from multiple perspectives. This included workshopping gaps in our product, reviewing existing products in the market, conducting literature reviews, and assessing information that we could potentially integrate into the app based on our capabilities at the time.

Key insights

Competitor banks and other existing products in the market often fail to sufficiently communicate the various methods users can use to improve their credit scores, particularly when addressing issues like late or missed payments. These strategies may include requesting forgiveness to remove missed payment records from credit reports, maintaining credit balances below 50%, disputing inaccurate information, and implementing other proactive measures.

Much of the information, such as credit history and reports, was accessible through our existing partner, TransUnion, enabling us to display it within the app. Additionally, other initiatives in progress aligned with the proposed alerts framework. The challenges customers faced in accessing their current credit score underscored the need to reimagine the Information Architecture (IA) or onboarding process for this feature.

3 phased approach

Since there were numerous critical improvements identified, we organized them into three distinct phases.

Phase 1: Enhancing Information Architecture (IA) and integrating a credit score report to provide users with a comprehensive view of their financial history, empowering them to better comprehend their current score.

Phase 2: Implementing an alert framework to highlight changes in credit score, linked to customers' Scotia products, from low to high importance.

Phase 3: Introducing insights and actionable tasks aimed at improving credit scores.

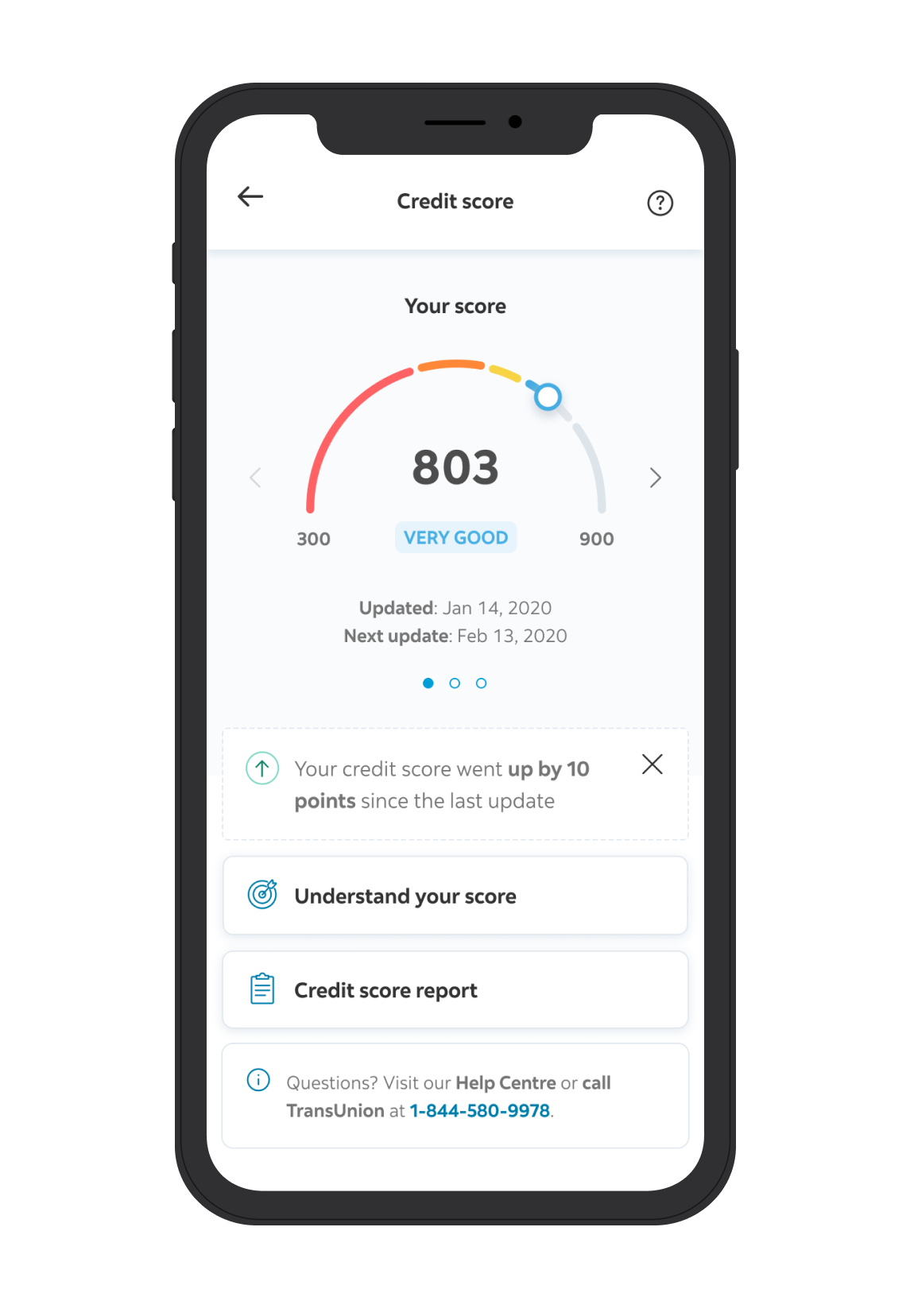

Landing screen

Users can easily access a credit score overview directly from the home screen. Upon landing on the credit score screen, they are greeted with essential information, including their credit score and trends, displayed in a carousel at the top. Any alerts related to the score are presented below along with links to more detailed information.

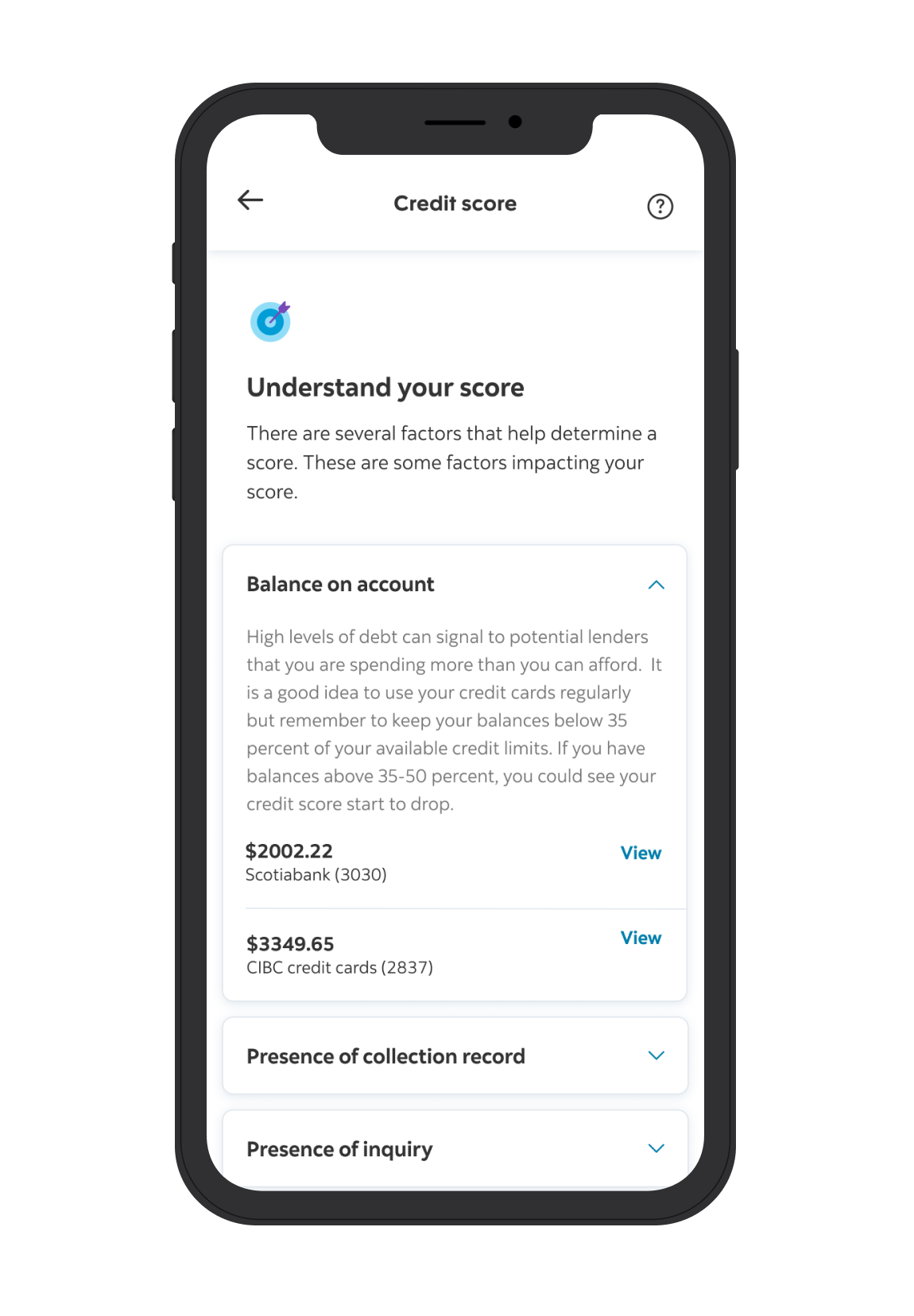

Understand your score

To avoid overwhelming the user, the content focuses on highlighting the factors that have the most significant impact on their credit score. Contextual information from their accounts is provided to illustrate how these factors affect their score, presenting a cohesive story and aiding in sense-making.

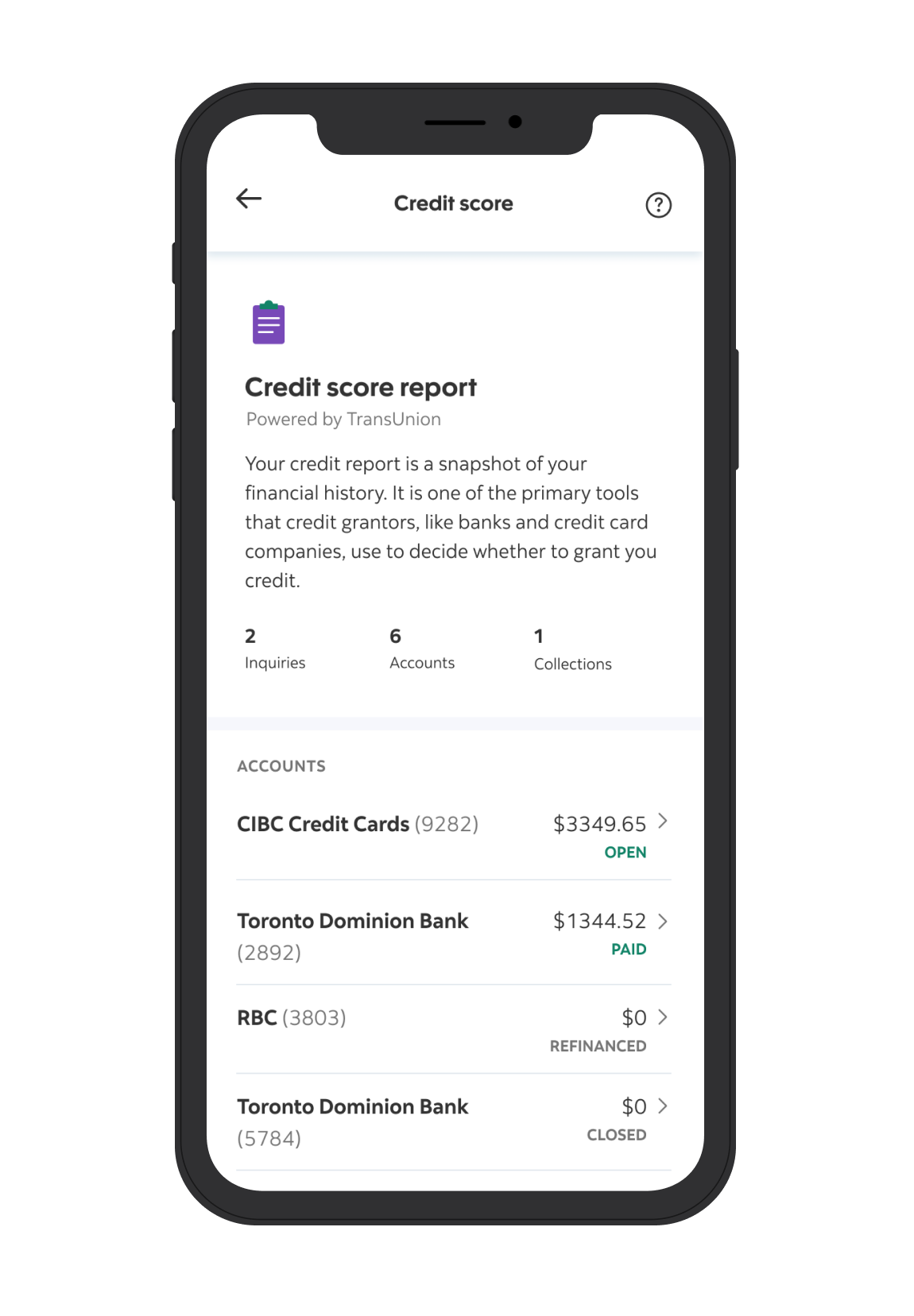

Credit score report

A credit report serves as a comprehensive record of an individual's credit history, encompassing their borrowing and repayment activities. By presenting the credit report in context, users gain transparency regarding past records, including closed accounts, which may impact their current credit score.

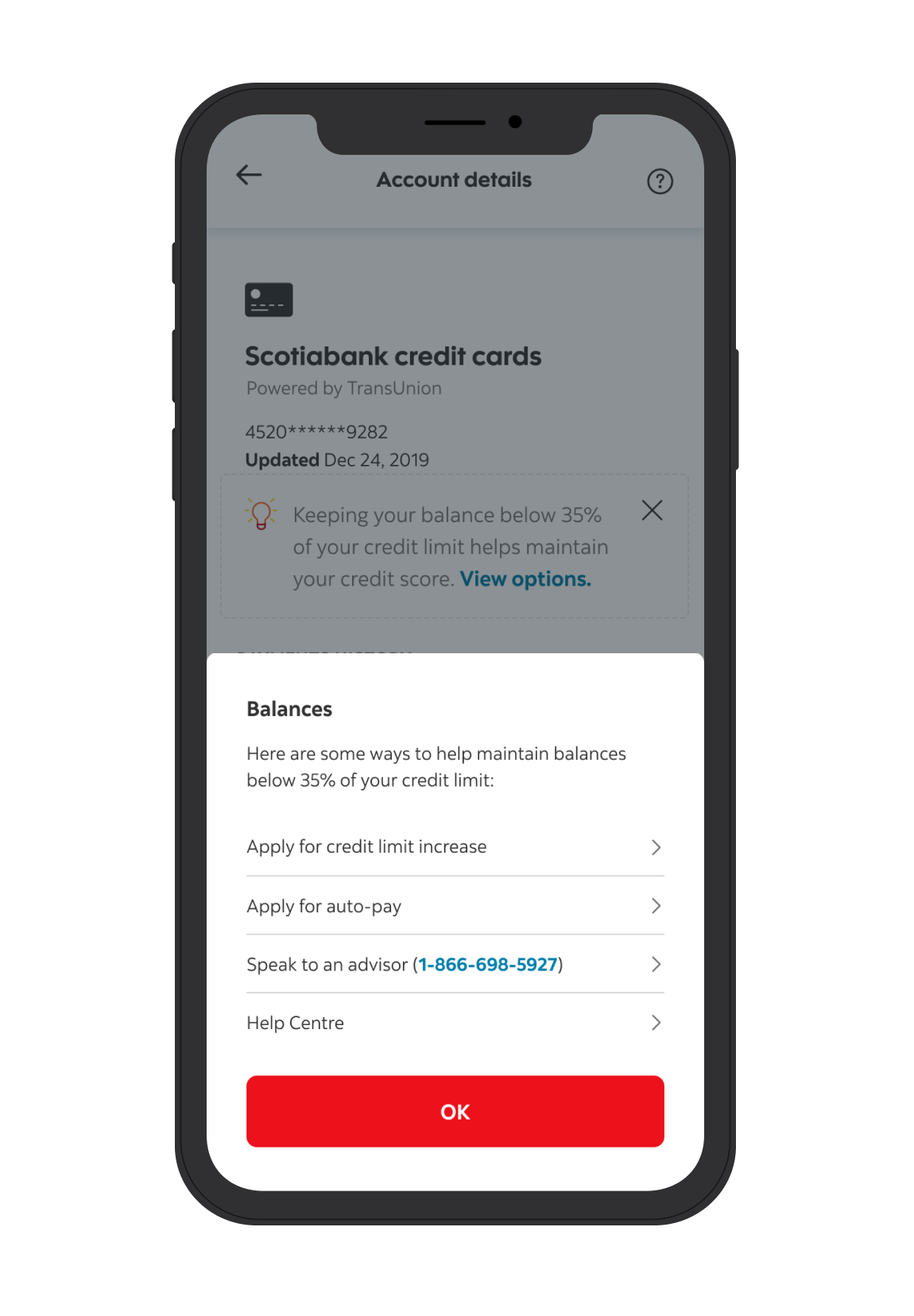

Contextual guidance

Simply showing information and providing transparency isn't enough. It's equally important to offer users easy guidance on improving their credit score. Contextual options help customers identify ways to manage their accounts better and improve their credit score.

:)

:)

Social media

©2021